net investment income tax 2021 trusts

The estates or trusts portion of net investment income tax is calculated on Form. Net investment income NII is income received from investment assets before taxes such as bonds stocks mutual funds loans and other investments less related.

Here Are Some Savvy Tax Efficient Investment Strategies

The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year.

. Allowing an additional 15 percent top income tax rate reduction to 48 percent. 1 It applies to individuals families estates and trusts. Effective January 1 2013 Code Sec.

5 hours agoEliminating the bottom income tax bracket allowing Missourians to earn their first 1000 tax free. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified. 1411 imposes the 38-percent Net Investment Income Tax NIIT on the net investment income of individuals trusts and.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Since the modified adjusted gross income exceeds the threshold amount of 200000 for single taxpayers by 90000 while the net investment income is 120000 the. As a result any net investment income generated by the trust is included in the grantors net investment income potentially subject to the 38 tax at the individual level.

Generally net investment income includes gross income from interest dividends annuities and royalties. April 28 2021 The 38 Net Investment Income Tax. The Net Investment Income Tax does not apply to any amount of gain that is excluded from gross income for regular income tax purposes 250000 for single filers and.

Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

Net Investment Income Tax Niit The Accounting And Tax Canada

Trust Tax Rates And Exemptions For 2022 Smartasset

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

How To Analyze Reits Real Estate Investment Trusts

Trusts Estates And The Net Investment Income Tax Withum

Income Tax Accounting For Trusts And Estates

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

What You Need To Know About Capital Gains Tax

Assault On Family Businesses Continues The S Corporation Association

3 8 Net Investment Income Tax Td T

What You Need To Know About Capital Gains Tax

Income Tax Law Changes What Advisors Need To Know

Owning Gold And Precious Metals Doesn T Have To Be Taxing 2021

2021 Trust Tax Rates And Exemptions

The 65 Day Rule Post Year End Tax Planning For Estates And Certain Trusts Boeckermann Grafstrom Mayer

The Impact Of The Net Investment Income Tax On Estates And Trusts

Capital Gains Tax In The United States Wikipedia

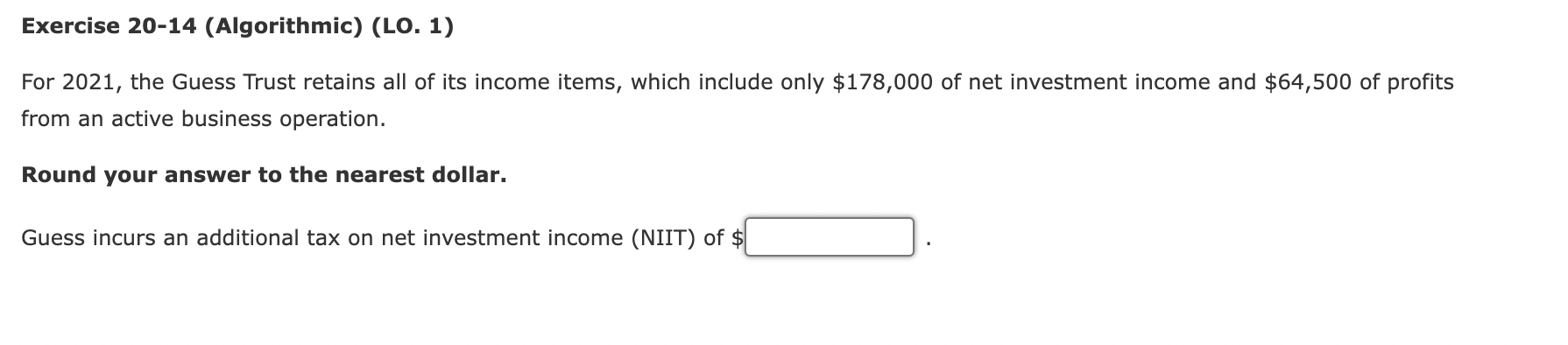

Solved Exercise 20 14 Algorithmic Lo 1 For 2021 The Chegg Com

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide